What is the COBRA Plan and Why is It Important?

- Admin

- 0

- Posted on

When life takes an unexpected turn—such as job loss, reduced hours, or major life changes—health insurance continuity becomes a serious concern. That’s where the COBRA plan plays a critical role.

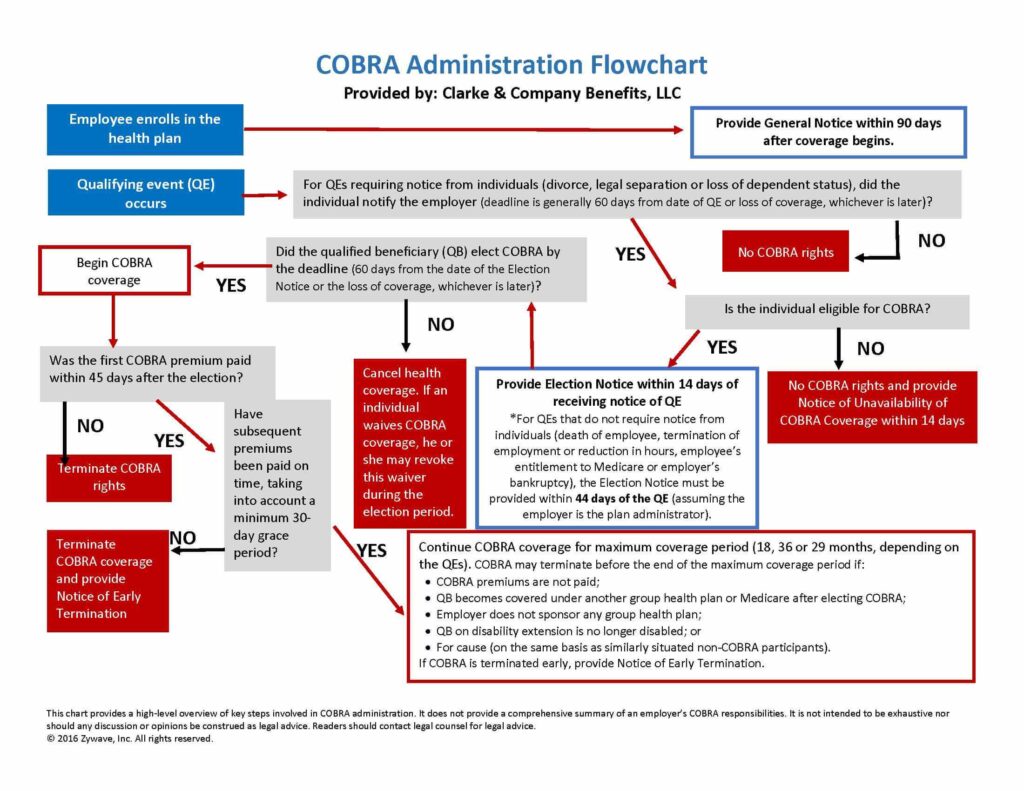

COBRA (Consolidated Omnibus Budget Reconciliation Act) is a federal law that allows individuals to temporarily keep their employer-sponsored health insurance after experiencing a qualifying life event.

⚙️ How Does COBRA Work?

When you’re eligible, COBRA allows you to continue your current group health plan for up to:

- 🗓️ 18 months after job loss or reduced work hours

- 🗓️ 36 months after divorce, death of a covered employee, or a dependent aging out

- 💡 Note: You’ll pay the full premium yourself—including the employer’s portion—plus a 2% administrative fee.

👤 Who Is Eligible for COBRA?

COBRA applies to employers with 20 or more employees offering group health plans. You may be eligible if you’re:

- 👨💼 An employee who lost a job (except for gross misconduct)

- ❤️ A spouse or ex-spouse of the covered employee

- 👶 A dependent child who was covered under the plan

⭐ Why Is COBRA Important?

COBRA plays a vital role in maintaining healthcare access during uncertain times. Here’s why it matters:

- 🩺 Continuity of Care – Keep seeing the same doctors and continuing treatment without disruption.

- 🌉 Temporary Bridge – Helps you stay covered between jobs or while transitioning to another plan.

- 🧘 Peace of Mind – Reduces anxiety during stressful life changes by preventing loss of coverage.

- ⚖️ Legal Protection – Your right to continue coverage is protected under federal law.

❓ Is COBRA Always the Best Option?

Not always. While it ensures seamless continuity, COBRA can be costly because your employer no longer contributes. Consider these alternatives:

- 👩❤️👨 Joining your spouse’s health plan

- 🛍️ Exploring plans on the Health Insurance Marketplace

- 🩹 Checking eligibility for Medicaid

- 💡 Tip: You have 60 days to decide after becoming eligible. Use this time to compare options carefully.

📝 Final Thoughts

COBRA gives individuals and families a lifeline by allowing them to continue health coverage in the face of major life changes. It’s not always the most affordable path, but it is a dependable one—especially when you need time to explore your next steps.

📞 Need help navigating your COBRA options?

Talk to our team of insurance experts and get clear, customized advice to protect your health and peace of mind.